Regional business leaders talk about the outlook for the year ahead, plus demographics and statistics

Amy Martinez | 1/17/2022

Read the original article

FORECAST / RETAIL

FORECAST / RETAIL

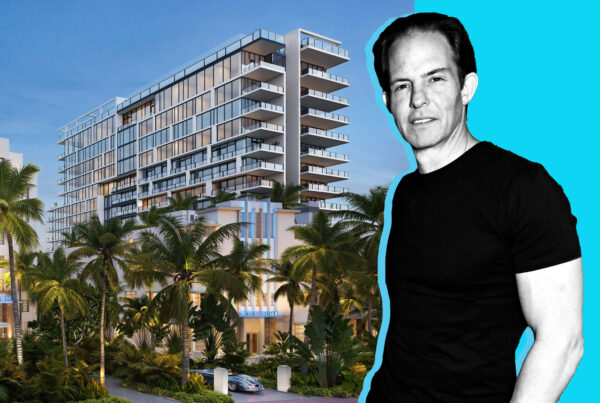

LYLE STERN

President, Koniver Stern Group | President, Lincoln Road Business Improvement District, Miami Beach

“We’ve never been busier, and it’s because so many are looking for so much at the same time — everybody from luxury and aspirational luxury to street-level retail and restaurants, both high-end and casual, all the way through to Walmart, Target and Dollar General stores. There’s so much population explosion, and that population requires retail. The biggest issue in the restaurant world in Miami today is getting a seat. So many restaurants have cut down on their hours of operation because there simply aren’t enough employees to go around.

The Zara store on Lincoln Road continued to do well enough during the pandemic that it’s now expanding by 10,000 square feet. Andres Carne De Res, which is probably the go-to restaurant in Bogota, has leased an entire building on Lincoln Road. Mila, one of the go-to restaurants in Florida today, is expanding by 4,500 square feet and adding an omakase restaurant as part of that expansion. (Chinese fast-fashion chain) Yoyoso announced that it will open its first store in Florida on Lincoln Road, and that’s finally under construction. Amazon took a 5,000-sq.-ft. corner on Lincoln Road for one of its 4-Star stores. That went into hibernation during the pandemic and is now well under construction and expected to open in Q1 2022.

There’s a lot going on around Lincoln Road that’s quite positive. The population of Miami Beach continues to elevate itself. It looks like Ocean Drive will be reopened to traffic. International tourism is restarting, and the convention center has reopened and already has had some significant conferences. The lights have very much come back on.”

Retail Resurgence

Retail Resurgence

Miami retailers are in better shape coming out of the pandemic than U.S. retailers overall, according to a report from commercial real estate brokerage firm Marcus & Millichap. The firm’s third-quarter 2021 report notes that retail vacancy rates in the area have returned to pre-pandemic levels, rents are rising, and about 3.7 million square feet of retail space is in development, with nearly 90% of it pre-leased.

“Despite a recent increase in COVID-19 cases, large tracts of Florida’s economy have remained open, supporting retailers,” the report says. “Vacationers seeking areas with more lax restrictions have sought out South Florida over the course of the last several months.”

Demographics have also favored the market as more people accelerated retirement plans and moved to the area. Over the past year, the population age 65 and older has grown 3.5%, outpacing the national rate of 3.1%. The report adds that retail sales in Miami jumped 28.5% in the past year “as more residents ventured out to take advantage of local amenities and travelers flocked to the area.”

Miami Worldcenter, a $4-billion, 27-acre mixed-use project under construction in downtown Miami, is to open 130,000 square feet of new retail space this year, adding to the 150,000 square feet of retail space it already has completed. Signed tenants include cosmetics retailer Sephora, electric car company Lucid Motors and game venue Bowlero.

MIAMI BEACH

Urbin, a planned six-story coliving and hotel project on Washington Avenue in South Beach, is selling units for $400,000 and up. An adjacent 1960s office building will be converted to co-working space. Developer Location Ventures, which has raised nearly $100 million for the project, also plans to build an Urbin condo-hotel in Coconut Grove. Owners will be able to live in a unit for up to 90 days a year, and Urbin will rent it out for short- or long-term stays the rest of the year.

Texas-based CourMed, a concierge health and wellness startup, will open a regional office in Miami Beach, creating at least 10 jobs with an average wage of $80,000.